Paying Down Student Loans Faster in 2022

Tim Fraticelli is a Physical Therapist, Certified Financial Planner™, and founder of PTProgress.com. He loves to teach PTs and OTs ways to save time and money in and out of the clinic, especially when it comes to documentation or continuing education. Follow him on YouTube for weekly videos on ways to improve your physical and financial health.

Travel Therapy Tips for a Debt-Free Future

With student loan payments back in full force for 2022, it’s important to have a game plan for paying them off as quickly as possible. Borrowers have enjoyed a nearly 2-year holiday for their federal student loan payments, but time is almost up. Take command of your debt and consider adopting a few of these 3 strategies for paying down student loans faster in 2022.

Search Allied Jobs in Your Specialty Now

Maximize Job Opportunities

The first strategy toward a faster debt payoff is something called “getting a bigger shovel.” If you have a mountain of debt, a small spade won’t help you nearly as big shovel—or several shovels—could.

Your income is your shovel. A single income stream may be enough for a small amount of debt, but if you owe student loans into the hundred thousands of dollars, you probably don’t make enough as a PT or nurse to tackle it with one job. The good news is that there are more jobs out there, and it’s never been easier to diversify and multiply your income.

Whether you are a nurse, PT/OT, or other healthcare professional, you’ve probably noticed the high demand for workers in your field, as job vacancies plague healthcare organizations across the country. According to the American Hospital Association, the number of job vacancies for nurses alone rose by 30% this past year. Such increased demand presents a huge opportunity to job seekers interested in paying down student loans, because there’s always more work—and more hours—to be had.

Job seekers who are willing to travel are especially in demand, and many travel jobs pay decently well. A travel position—such as a travel nursing job or a 13-week traveling therapist contract— could boost your monthly income by $1,000 to $2,000, which will more than cover the average student loan payment of nearly $400 a month. Plus, applying an additional $1,000 each month to your principal balance means you will pay less interest overall and free yourself of student loans much faster.

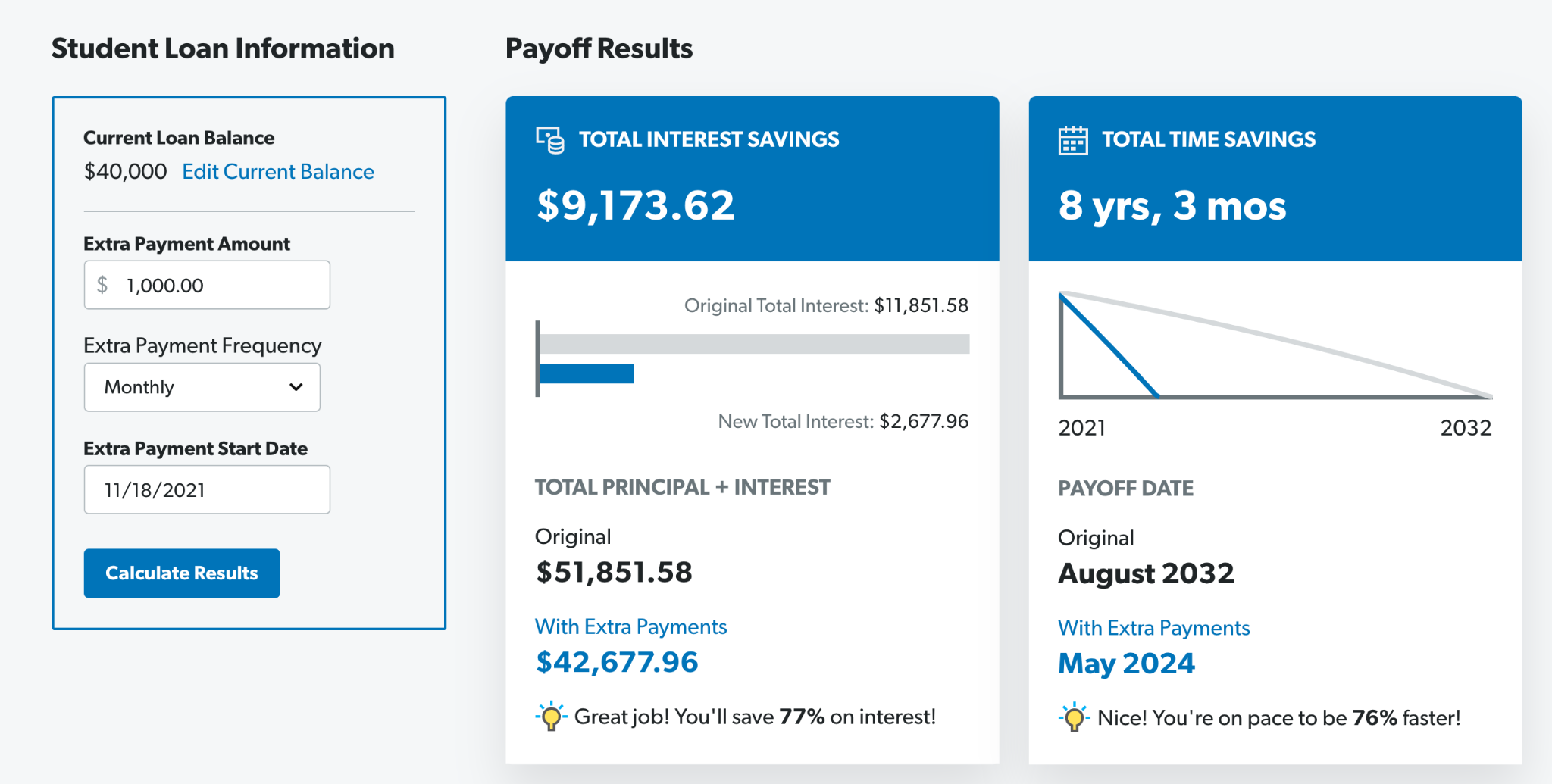

For example, suppose a borrower has $40,000 in student loans at a 5% interest rate and a $400/mo. payment. Not only will an extra $1,000 per month payment save them over $9,000 in interest, but it will also enable them to pay off their loan in just 2 and a half years instead of 10. (See loan payoff calculator here.)

Imagine the freedom of having no student loans! For travel therapists and nurses who set aside the extra income they earn while traveling, that dream can become a reality faster than you think!

Refinance High Interest Student Loans

The second way to find relief from student debt is to refinance your loans for better terms. The term of your loan includes the length of the loan and the interest rate. A longer term means a lower monthly payment, whereas a shorter term (say, 7 years instead of the usual 10) will increase the monthly payment and bring your debt payoff finish line that much closer.

Refinancing your loans—both private and federal—will also give you the opportunity to land a lower interest rate with a new lender. A change in rate from 6.5% to 2.5% could save you thousands of dollars in interest over the life of the loan.

Another option to consider is Federal student loan consolidation. Consolidation brings together multiple loans into one Direct Consolidation loan, which has one fixed interest rate and requires just one monthly payment.

As we enter 2022, loan rates continue to sit at record lows. So, it’s important to find a student loan servicing company that will give you the best terms possible for your refinanced loan.

Personally, I’ve used Splash Financial to find a much lower rate for my private student loans, lowering my monthly payment and saving me thousands of dollars as a result. Regardless of the company, a reputable loan servicer can help you lower your interest rate so that you can get out from under your student loans even faster.

Remember: student loan refinancing and consolidation may lower your monthly payment, but you can free yourself of debt even faster by applying extra payments to your new loan each month.

Get Financially Organized

It’s a lot easier to tackle your student loans and reach your financial goals when you have a solid financial plan to keep you focused. That’s why I recommend every borrower use both a personal budget to track monthly expenses as well as a balance sheet to monitor their progress in paying down debt.

To keep a budget, all you really need is a spreadsheet and the discipline to maintain it. But these days, there are all kinds of budgeting apps and tools to assist. A budget software like Mint.com or YNAB can help you see exactly where your money is going each month. These apps synchronize with your bank accounts, eliminating the arduous manual tracking of the spreadsheet method without losing its exactitude.

Whenever you review your actual spending (and not just your mental estimates), you can more easily identify the “holes” in your spending plan and reallocate that money towards your student loans.

To stay organized, I recommend setting up a separate savings account and labeling it “student loan payoff account.” With each paycheck or bonus, add money into the account. Once it reaches a certain threshold, such as $1,000 or $2,500, transfer that amount to your student loans. This strategy gives you a smaller target and a monthly sense of accomplishment, and you’ll be more motivated to direct your dollars towards your goals. Better yet, consider setting up an automatic transfer to your student loan savings account. Making debt payoff a priority—both in your budget and in your habits—will reward your efforts tenfold.

Besides using a budget app, you can also monitor your progress with a personal balance sheet. A great financial tool, a personal balance sheet helps you track your assets (what you own) and your liabilities (what you owe). A balance sheet will inform you of your net worth, which is essentially your income and assets minus your liabilities and debt. Paying off your student loans directly affects your total net worth—more reason to pay it off as soon as possible.

Final Thoughts on Paying Down Student Loans

While student loans can leave you feeling financially strapped with a negative net worth, you can take charge of your financial future with the strategies discussed in this article. The steps you take now to maximize your job opportunities or to refinance your student loan can help you pay off your student loans faster and achieve your financial goals sooner.

Interested in pursuing a career in travel therapy? Learn more about the current nationwide opportunities AMN Healthcare has to offer.

* The advice provided and opinions expressed by Tim or PT Progress belong solely to him and do not reflect the views of AMN Healthcare.

Additional Allied Travel Resources

While you continue your search for the perfect allied healthcare position, AMN Healthcare provides great resources to keep your career moving in the right direction. Begin the application process now, and then learn more about how AMN Healthcare can help you keep your career on the move.

- EAP: Our allied travelers gain access to a valuable set of Employee Assistance Program benefits.

- Allied Travel Jobs by Specialty: Explore allied jobs and learn about hourly salaries and the benefits of working in travel jobs.

- Search All Allied Jobs: Uncover new possibilities in your allied career by exploring both short and long-term options.

- Allied Healthcare Jobs: Learn how we can help move your career in amazing directions, both professionally and geographically by exploring opportunities by each state.

- More Allied Resources: Use the content here to learn everything you need to know about our allied recruitment process, including information on salary and benefits.